The Federal Reserve Board on Thursday produced its hypothetical scenarios for a next spherical of bank worry exams. Earlier this year, the Board’s initial spherical of worry exams located that significant financial institutions were very well capitalized beneath a selection of hypothetical activities. An more spherical of worry exams is being performed because of to the continued uncertainty from the COVID party.

Massive financial institutions will be analyzed from two scenarios featuring critical recessions to evaluate their resiliency beneath a selection of results. The Board will release firm-distinct effects from banks’ functionality beneath both scenarios by the conclude of this year.

The Board’s worry exams aid assure that significant financial institutions are equipped to lend to households and firms even in a critical economic downturn. The workout evaluates the resilience of significant financial institutions by estimating their bank loan losses and money levels—which offer a cushion from losses—under hypothetical economic downturn scenarios in excess of 9 quarters into the foreseeable future.

“The Fed’s worry exams previously this year showed the energy of significant financial institutions beneath quite a few various scenarios,” Vice Chair Randal K. Quarles mentioned. “Even though the economy has improved materially in excess of the very last quarter, uncertainty in excess of the course of the up coming several quarters remains unusually substantial, and these two more exams will offer much more data on the resiliency of significant financial institutions.”

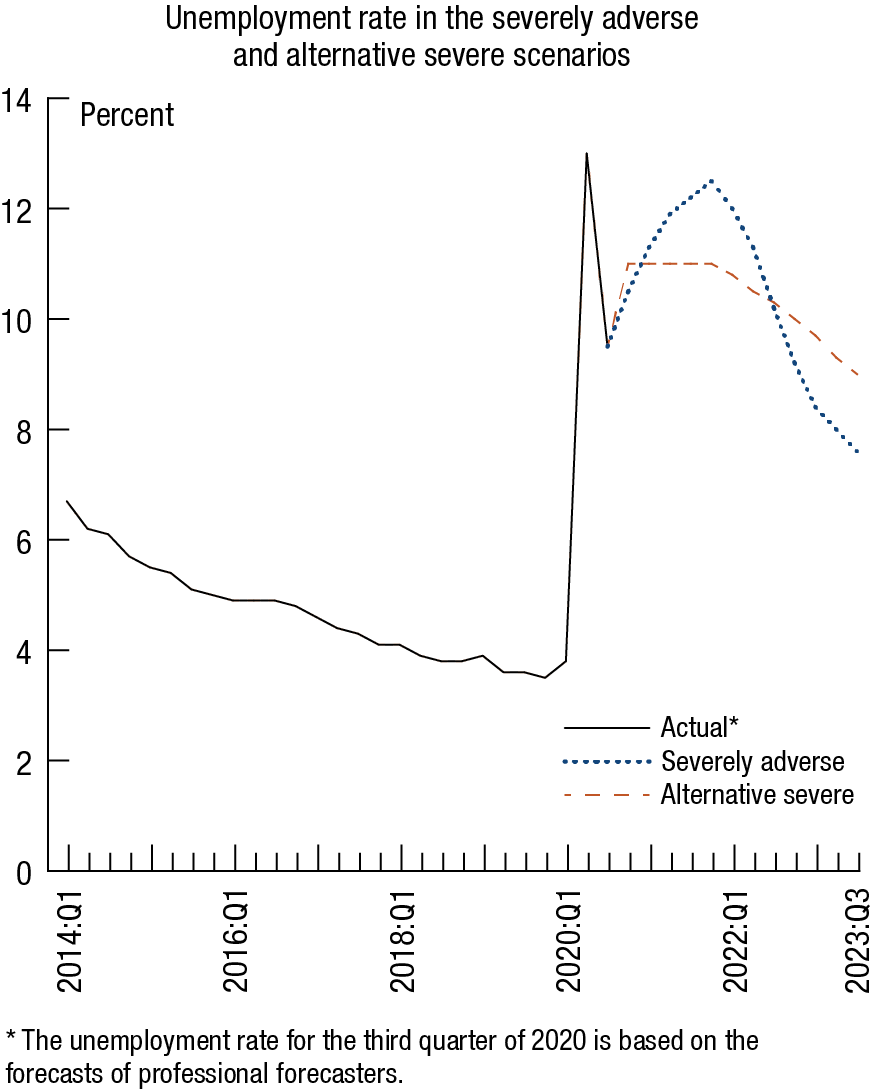

The two hypothetical recessions in the scenarios element critical global downturns with sizeable worry in economical marketplaces. The initial scenario—the “severely adverse”—features the unemployment price peaking at twelve.5 % at the conclude of 2021 and then declining to about 7.5 % by the conclude of the scenario. Gross domestic product or service declines about 3 % from the 3rd quarter of 2020 by way of the fourth quarter of 2021. The scenario also capabilities a sharp slowdown overseas.

The next scenario—the “substitute critical”—features an unemployment price that peaks at 11 % by the conclude of 2020 but stays elevated and only declines to 9 % by the conclude of the scenario. Gross domestic product or service declines about 2.5 % from the 3rd to the fourth quarter of 2020. The chart beneath reveals the route of the unemployment price for just about every scenario.

The two scenarios also involve a global industry shock part that will be used to financial institutions with significant buying and selling functions. All those financial institutions, as very well as selected financial institutions with sizeable processing functions, will also be necessary to incorporate the default of their biggest counterparty. A desk beneath reveals the elements that implement to just about every firm.

The scenarios are not forecasts and are drastically much more critical than most current baseline projections for the route of the U.S. economy beneath the worry tests interval. They are created to evaluate the energy of significant financial institutions in the course of hypothetical recessions, which is specially proper in a interval of uncertainty. Each scenario contains 28 variables masking domestic and intercontinental financial exercise.

In June, the Board produced the effects of its yearly worry exams and more analyses, which located that all significant financial institutions were sufficiently capitalized. Nevertheless, in light of the heightened financial uncertainty, the Board necessary financial institutions to consider numerous steps to preserve their money stages in the 3rd quarter of this year. The Board will announce by the conclude of September whether these actions to preserve money will be prolonged into the fourth quarter.

| Bank | Matter to global industry shock | Matter to counterparty default |

|---|---|---|

| Ally Monetary Inc. | ||

| American Express Organization | ||

| Bank of The usa Corporation | X | X |

| The Bank of New York Mellon Corporation | X | |

| Barclays US LLC | X | X |

| BMO Monetary Corp. | ||

| BNP Paribas United states of america, Inc. | ||

| Capital One particular Monetary Corporation | ||

| Citigroup Inc. | X | X |

| Citizens Monetary Group, Inc. | ||

| Credit Suisse Holdings (United states of america), Inc. | X | X |

| DB United states of america Corporation | X | X |

| Discover Monetary Providers | ||

| DWS United states of america Corporation | ||

| Fifth 3rd Bancorp | ||

| The Goldman Sachs Group, Inc. | X | X |

| HSBC North The usa Holdings Inc. | X | X |

| Huntington Bancshares Included | ||

| JPMorgan Chase & Co. | X | X |

| KeyCorp | ||

| M&T Bank Corporation | ||

| Morgan Stanley | X | X |

| MUFG Americas Holdings Corporation | ||

| Northern Have confidence in Corporation | ||

| The PNC Monetary Providers Group, Inc. | ||

| RBC US Group Holdings LLC | ||

| Regions Monetary Corporation | ||

| Santander Holdings United states of america, Inc. | ||

| State Street Corporation | X | |

| TD Group US Holdings LLC | ||

| Truist Monetary Corporation | ||

| UBS Americas Keeping LLC | X | X |

| U.S. Bancorp | ||

| Wells Fargo & Organization | X | X |

For media inquiries, contact 202-452-2955

More Stories

The Ministry of Finance for the first time paid income on Eurobonds in rubles

Russia to make dollar bond payments in roubles after US blockade

Russia to make dollar bond payments in roubles after US blockade