The Centre is thinking about several selections which includes “zero or token quality of Re 1” for the 12 crore tiny and marginal farmers less than the flagship Pradhan Mantri Fasal Bima Yojana (PMFBY) amid several States expressing their dissatisfaction, some even had earlier stop the scheme thanks to economical burden.

“We are open to any possibility for the betterment of the scheme. The doing work team has been established up for the reason and they will attract up monetary projections on a variety of choices,” stated a senior formal of the agriculture ministry. On the other hand, the significant concern is the condition share of premium subsidy as it will go up with the enhanced participation of farmers, centered on the existing tips, the formal claimed.

Twin high quality alternative

A further choice underneath thing to consider of the team is to have dual top quality for the insured total so that farmers are not burdened and economical burden on States simplicity, sources stated. “If the liability of insurance company is fixed at 50 for every cent of the assert quantity, the top quality will greatly lower in which circumstance farmers’ share can be totally waived off,” an sector supply privy to the deliberations mentioned. But there is also to be a system out there to pay 100 per cent claim quantity, he added.

In look at of about 17 for each cent of agricultural land leased out, which is as substantial as 42 for every cent in Andhra Pradesh, the government may perhaps also relieve principles to enable lessee farmers choose the advantage of crop insurance. While they are permitted to enroll under PMFBY by displaying documentary proof of contract farming, it is primarily absent as numerous farmers favor to do it without the need of record.

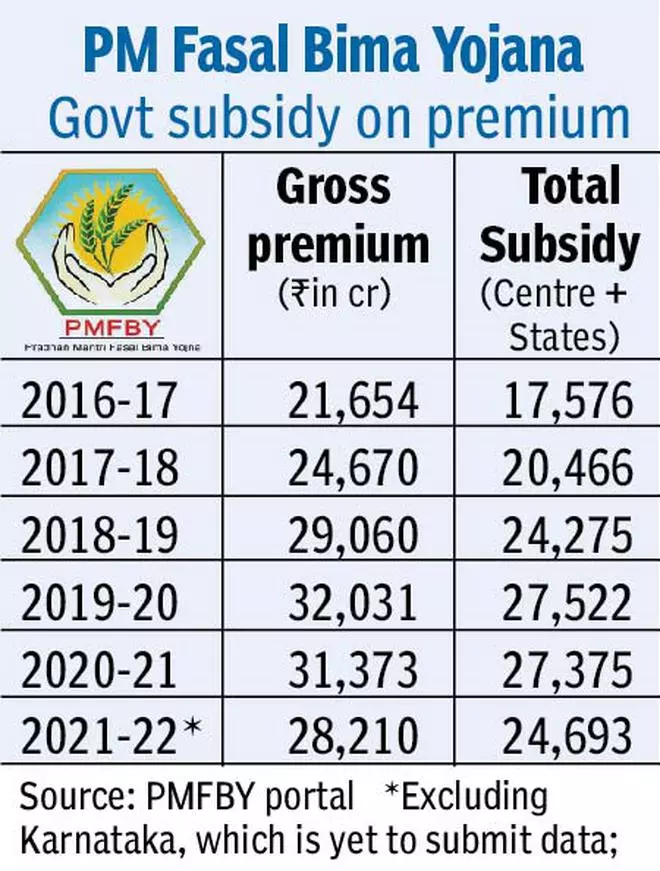

Under PMFBY, the stability premium is split equally amongst the Centre and states immediately after farmers fork out a mounted top quality – 1.5 for each cent (of sum insured) in Rabi season, 2 per cent in kharif and 5 for every cent for money crops. The top quality is arrived at dependent on quotations from insurance companies in a cluster. The Centre has capped optimum premium at 30 for each cent in non-irrigated locations, 25 per cent in irrigated locations.

Many experts have pointed out quite a few anomalies in the scheme owing to which farmers, Condition governments and insurance coverage companies are not content with the latest plan. For instance, in Uttarakhand the farmers share of quality in Kharif 2019 was ₹6.04 crore while the Centre and Condition share of subsidy was about ₹94 lakh despite government bearing 90 for each cent of the subsidy since it is hilly state.

“Such micro concerns are not able to be brushed aside if PMFBY is to be created acceptable universally throughout all the states. Technologies driven yield assessment need to be designed mandatory and the Centre should undertake this exercising from its own fund with the concurrent of the State authorities,” reported a previous Union Agriculture Secretary.

States exited central plan

Gujarat, Andhra Pradesh, Telangana, Bihar, Jharkhand and West Bengal have currently exited from the Central scheme launching their very own although Maharashtra is weighing the pros and drawbacks of withdrawal.

Officials position out that crop insurance plan is vital to mitigate possibility of the farmers, but the recognition level is very low due to which even lots of farmers presume that there has to be some returns for their top quality even if there is no crop reduction. In Lok Sabha previous December, an MP wanted to know if top quality will be lifted by the federal government in view of calamities, the official reported, adding a lot of individuals are not aware that rates are decided as a result of bids.

Released on

February 06, 2022

More Stories

7 Home Business Ideas For Women That Work

Business Solutions to Peoples’ Needs

eFoods Global Business Opportunity Review – Emergency Food For Long Term Storage